Yes. Watch the 10Y US bond -

The central banks have driven down interest rates bigly after 2008 crisis / quantitative easing. They looked into abyss of debt deflation and witnessed death. Unlike iceland who let institutions and banks crumble and let dry powder come in, buy up assets from bankruptcy they saved the status quo / debt holders big and small by driving down interest payments with q.e.....

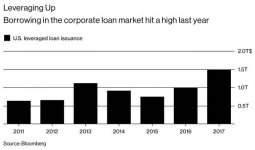

The flood of money entered markets companies started borrowing at ultra low rates ( explosion of more debt ) and doing share buybacks ( financial alchemy ).

Me, you most everyone never witnessed recovery at work. Until last quarter no real growth, always a hard slog up and down at work as real world organic growth never match the markets recovery and bubble expansion.

The central banks have driven down interest rates bigly after 2008 crisis / quantitative easing. They looked into abyss of debt deflation and witnessed death. Unlike iceland who let institutions and banks crumble and let dry powder come in, buy up assets from bankruptcy they saved the status quo / debt holders big and small by driving down interest payments with q.e.....

The flood of money entered markets companies started borrowing at ultra low rates ( explosion of more debt ) and doing share buybacks ( financial alchemy ).

Me, you most everyone never witnessed recovery at work. Until last quarter no real growth, always a hard slog up and down at work as real world organic growth never match the markets recovery and bubble expansion.