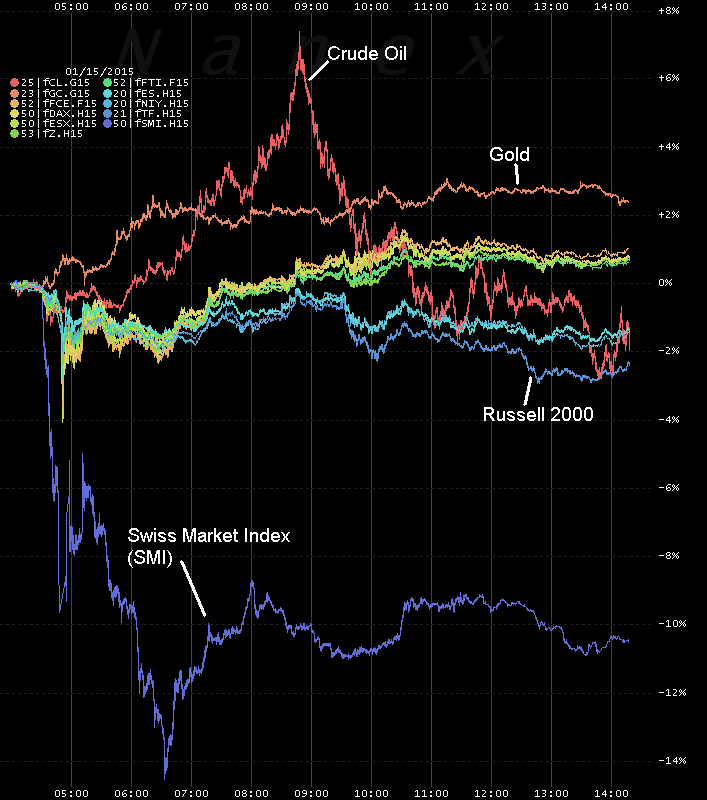

Wow. Brutal day in the markets.

NAS down almost 3.5% on the Bio-Tech bubble popping. Momo bubble getting close to popping.

Are investors finally figuring out that the Federal Reserve has no idea WTF they are doing?

"I see dead people."

NAS down almost 3.5% on the Bio-Tech bubble popping. Momo bubble getting close to popping.

Are investors finally figuring out that the Federal Reserve has no idea WTF they are doing?

"I see dead people."