You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short term trades in the stock market •$$$$$•

- Thread starter TNTBudSticker

- Start date

^^ All markets and currencies are 'ponzi schemes'. Madoff said that and was right, he should know.

This market will hold as long as it can. It could go on for decades or longer. If you are expecting the market to crash and burn, you might want to worry about asteroids too.

This baby can just go on and on.... Or crash and burn, of course it can, but not likely real soon. 2008 was not a crash and burn, just a crash and not that bad at that.

Any ones thoughts on holding gold long term now? I think these stimulus things are inflating and therefore good for gold?

This market will hold as long as it can. It could go on for decades or longer. If you are expecting the market to crash and burn, you might want to worry about asteroids too.

This baby can just go on and on.... Or crash and burn, of course it can, but not likely real soon. 2008 was not a crash and burn, just a crash and not that bad at that.

Any ones thoughts on holding gold long term now? I think these stimulus things are inflating and therefore good for gold?

Last edited:

This crowd loves the idea of having gold and silver in HAND. It doesn't matter how long any ponzi lasts, us hairless monkeys have been valuing physical silver and gold for thousands of years

It wasn't the GLD that was the good gold play always tell people to check out the ticker "GOLD" /Rangold Resources that beat the GLD by 20% since aug 1rst ! When GLD traded mostly sideways all day , even with friday's opening romp GOLD was up another 7pts in the premarket making it to $122 ! Just squeezed mercilessly and making a total of 39% gain in Aug to GLD whatever , it just makes monster moves . It was an easy scalp fade from there , so many were after these runnups.

Did you notice so many gap fades were outstanding after the bots ran things up early? Not only was the SPY a great fade from $148 "even" but

AMZN gapped to 264 pulled back to 260=4pts

CF gapped to 227.80 pulled back to 222 =5pts, almost 6pts

CRM to 162 faded back to 158 =4pts

MLNX from 105's down to 101 was another=4pts

CMG from 343.50 down to 335 =7pts

Last EOD 2nd fades on PCLN =7pts and AMZN almost 3pts .

(The market at these high levels has had this late day "Sell-a-Thon" lately

that has been really good for fades too)

If you have any of those good trades ^^ in advance so I can trade them, throw them out there Madrus.

I would be willing to bet on one.

Think I will stay long for next week, more of the same I hope. Bad jobs # equals fed stimulus or so the traders think. I also think it means Romney has a shot and they would prefer him.

The next call made by that Options wiz Jimmie after LNKD, PCLN & CMG homeruns was on WYNN , swear hes really hot & watched him do this last may Q1 .Sorry it all happened so quick thru AAPLs dip on CC day (what a bounce off 656 doubl bot low)and posting here intraday would next to impossible . so after doing $60k total on CMG he did another $40K on a WYNN bounce thru the Fed . (I did FFIV BIDU & CRM ISRG ,but sure wished i had followed him in on WYNN.)

I fed him ISRG last sunday when charting , looked like it should turn up , looked bottomed & a 2nd tier momo they might run so keep on watch hes already in . Hes also ontop of FOSL for some retailers popped on friday, RL DECK etc . CMG is still in play as is PCLN , earnings are getting near

Here's his results $1600 into $40k on WYNN in two days , balls of steel, held thru the Fed into Friday's ramp o rama in the am :

$WYNN 100 110 calls @ 16c to $4 - $1600 into $40k ~~~ one of many ill post later when my heart slows down

09/14/12 Sold to Close -6 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.90 $0.23 $2,398.87

09/14/12 Sold to Close -10 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $1.50 $0.36 $3,998.14

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -2 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.30 $0.08 $799.62

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -10 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $1.50 $0.36 $3,998.14

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -3 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.45 $0.12 $1,199.43

09/14/12 Sold to Close -2 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.30 $0.08 $799.62

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -3 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.45 $0.12 $1,199.43

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -2 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.30 $0.08 $799.62

09/14/12 Sold to Close -3 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.45 $0.12 $1,199.43

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -3 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.45 $0.12 $1,199.43

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -2 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.30 $0.08 $799.62

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -3 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.45 $0.12 $1,199.43

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -2 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.30 $0.08 $799.62

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Sold to Close -2 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $9.25 $0.08 $790.67

09/14/12 Sold to Close -1 WYNN Call Wynn Sep 14 2012 110.00 Call WYNN Sep 14 2012 110.00 Call $4.00 $0.15 $0.05 $399.80

09/14/12 Bought to Open 5 PCLN Call Pcln Sep 14 2012 645.00 Call PCLN Sep 14 2012 645.00 Call $0.75 $0.75 $0.13 -$375.88

So what's next?^^ After action reports are nice but I am looking to make money here.

ISRG FOSL are the plays now ,

CMG has been in the overbought , even with the fed was stymied though tried to gap so good trade fading its gap thursday frid..If you look intraday on PCLN friday it gaps to $645 on the buttin then fades from there exactly again & a 3rd EOD attemt to 643 falls back too some 7pts . I look for these intraday pivot supports & resistance and lately the market has been doing the "Sell A Thon" thingie EOD .

Look the fade on CRM after tagging $162 friday but the pros were really setting that up into the FED it got real strong all of a sudden weds thurs after holding 148 . The friday they cashed in , got to admit thats how its done , frigging GS was being a leading indicator all the way . They got it all AAPL coming thuru & Dovish fed so who ever played it long got well rewarded . Look at CF fertilizer & AGU , VMW IBM MA V and all the banks.

CMG he thinks will consolidate then pop again higher & bulls hoping PCLN will go all the way too, but everything trading in with the SPY now , thats the secret after fading the SPY at 148 i knew later tops would be fadeable cause SPY rolls they all roll. AMZN was trying to bid back up to $263.25 where i took a fade , then last 1/2 hr gravity kicked in fell back almost to 260 again .

Gravity is nice sometimes ;-)

thanks^^ I will look into CMG and PCLN and see if I can hold them for a few days at least. I cannot day trade right now.

That WYNN trade is just making me nuts.

See, ISRG popped almost 14pts right off this morning & CMG did about 14pts too while PCLN did about 11pts ;o)

$SPY was pretty ez fade from $147.10 along with AMZN which needed to pullback & consolidate and WYNN hit alot of resistance at 115 so sold right back down , Oil sold off $2 from $98 late day so some oils trades were hit a little .

Took a couple of fades on GOLD & EOG as gold is consolidating a little pulling back , OIl dropped a quick $2/barrel later from $98,only scalp trades but were good . Both of these of course are dangerous with any geopolitical ME event could fire these off again but figured for today that had near term been baked in the cake . Again Manufacturing data showed even more slowing .

CMG ISRG & PCLN all popped into the close near the highs , if a green day these prolly go higher , did fade both CMG PCLN later only because i knew the SPY would roll over later , PCLN from exactly that same 645 pivot , makes it easy when its that exact .

Last edited:

InjectTruth

Active member

Hey there fellas. I got lucky buying LVS in 09 when it fell to $2, but now Im lookin for a new horse.

Got my eye on SLV, but would rather take a physical position in silver, so scratch that. Tryin to hold no more than a week. Got about 6k free in the acct. Probably should have thrown it back down on LVS when it dipped to $36.

Take it easy, fellas. Ill be pokin my head in tryin to find a winner.

Got my eye on SLV, but would rather take a physical position in silver, so scratch that. Tryin to hold no more than a week. Got about 6k free in the acct. Probably should have thrown it back down on LVS when it dipped to $36.

Take it easy, fellas. Ill be pokin my head in tryin to find a winner.

I dont post much but I lurk this thread every day.

I liked how after gold and silver jumped on the QE3 I went and checked my stacks, yup, still there.... feels good holding something tangible.

I tell my friends about it, show em a silver eagle, most think I'm nuts but the more financially savvy ones are intrigued and quite interested in learning more.

those lists of options madrus, is that person selling the options or exercising them? No idea how to read that. I'm so green when it comes to options.

I liked how after gold and silver jumped on the QE3 I went and checked my stacks, yup, still there.... feels good holding something tangible.

I tell my friends about it, show em a silver eagle, most think I'm nuts but the more financially savvy ones are intrigued and quite interested in learning more.

those lists of options madrus, is that person selling the options or exercising them? No idea how to read that. I'm so green when it comes to options.

those lists of options madrus, is that person selling the options or exercising them? No idea how to read that. I'm so green when it comes to options.

Those 100 , $110/call options he bought to open on a down morning for WYNN (Casino) for a mere 16c , then in 48hrs appreciated to a whopping $4 or approximately 25times original cost and he sold to close there .

So he bought 100 contracts

$0.16 x 100 x 100 = $1600

WYNN popped up off $103 & went up past $110 & the calls went up to $4

$4.00 x 100 x 100 = $40,000

It doesn't happen all the time but this was the perfect market confluence of events that had some stocks dropping then rebounding fast of short squeezes as the Fed injected QEInfinity last thurs. It was a matter of siezing the opportunity & exercising the choice to make the right play ...that was that everything would pop on the stimulous .

Last edited:

And here comes everyone else joining in the BIG PRINT.....

Global Retaliation To QEternity Begin: BOJ Considers Additional Easing

QEternity was the last bullet the FED had. It has been jawboning the market higher for the past several months saying it would print. Just the talking has kept enough people front running the FED and kept the market higher. But now Bernanke is standing out in the freezing cold with his ding dong in his hands. He blew his load and has nothing left for the market to front run.

Now that the emperor has no clothes we shall see where we will go.

Global Retaliation To QEternity Begin: BOJ Considers Additional Easing

Last week it was the Fed crossing the Rubicon with infinite easing. We explained very clearly that the next steps would be everyone else joining the infinite easing party. Sure enough, here comes the first one:

BOJ TO CONSIDER ADDITIONAL EASING: NIKKEI

Keep in mind that the BOJ already monetizes ETFs and REITs, the very instruments which the Fed will soon be forced to buy. And so it begins - because when it comes to pushing CTRL and P, over and over, it really doesn't take much skill.

It also means that the next round of purchases of precious metals will come from everywhere else, in addition to just the US.

Finally, those wondering why there was absolutely no response out of the market to news that previously would have sent stocks soaring, the answer, as we explained before, is simple: the Fed has literally shot itself in the foot... and the head. Because when you tell the market to price in QEternity, you just can't hope any more QE anywhere, anytime, out of anyone, will be a surprise.

QEternity was the last bullet the FED had. It has been jawboning the market higher for the past several months saying it would print. Just the talking has kept enough people front running the FED and kept the market higher. But now Bernanke is standing out in the freezing cold with his ding dong in his hands. He blew his load and has nothing left for the market to front run.

Now that the emperor has no clothes we shall see where we will go.

We are liquidating the IRA. Taking the tax hit, pay the 10% penalty. 60% of something is better than 100% of nothing. Was thinking about custodial PM's under the IRA umbrella but realized that in the end if you can't stand there and defend it it's not yours. I wish I did not read Zero Hedge and I could live in blissful ignorance and believe that everything will turn out OK. But it feels very edgy, unstable, downright cataclysmal.

N

Nondual

Long story short S provided 2 opportunities off it's 10 MA recently to buy in before today's +7% pop which yielded 50-100% on calls depending on the month and strike price. QIHU is churning at 25 and RIC has kept chugging along.

Thing I see is yesterday or the day before FedEx stated they're seeing recession like activity, Norfolk Southern (NSC) railroad warned after hours today activity is less this time of year than last (moving less products for the consumer society) then the stock sold off hard and about a week ago the report was China used the least amount of oil compared to the last 22 months.

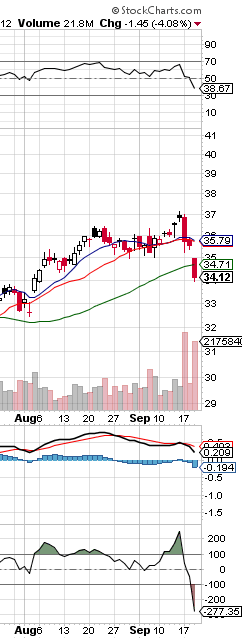

USO (crude) has crashed in the last 3 days on huge volume.

Thing I see is yesterday or the day before FedEx stated they're seeing recession like activity, Norfolk Southern (NSC) railroad warned after hours today activity is less this time of year than last (moving less products for the consumer society) then the stock sold off hard and about a week ago the report was China used the least amount of oil compared to the last 22 months.

USO (crude) has crashed in the last 3 days on huge volume.

N

Nondual

Transports, railroad companies, had a very tough day. I mentioned NSC already and that chart is absolutely UGLY today on INSANE volume. Through rails moves lumber, grains, chemicals...basically the heartbeat of the economy. The old adage the transports lead will hold up here IMO.

OK so here's the NASDAQ coming out of a classic ascending triangle. You could draw that top horizontal line of the triangle 50 points higher, or maybe stretching 100, still though 3200 is about where I think it will top out before, at the least, some type of correction happens. The stimulus effect is over...or soon to be. My vote is be on the short side of things at this point.

OK so here's the NASDAQ coming out of a classic ascending triangle. You could draw that top horizontal line of the triangle 50 points higher, or maybe stretching 100, still though 3200 is about where I think it will top out before, at the least, some type of correction happens. The stimulus effect is over...or soon to be. My vote is be on the short side of things at this point.

NSC guidance was horrible with trains hauling far less coal as Nat Gas rules & BBBY tank plus BOJ initiating new QE , whippy day with lots gap downs . While Oil stabilized off $90 was shorting this Alpha energy stock EOG from 119s & overbot but looked for it to bounce off the 20ma pullback @ 111.50 and bounce came in.

Funny day towards the end shorted AAPL just under $700 figuring they'd hold it down under , big blocks were waiting there got short 699.90, lol...and did fall back $2.20 right on Que . Triple witching tomorrow , ORCL reported with real light revs & still didn ding it much after hours .

Gold refuses to pullback of course ....

Funny day towards the end shorted AAPL just under $700 figuring they'd hold it down under , big blocks were waiting there got short 699.90, lol...and did fall back $2.20 right on Que . Triple witching tomorrow , ORCL reported with real light revs & still didn ding it much after hours .

Gold refuses to pullback of course ....

N

Nondual

NSC...wish I had the crystal ball out for this one.

Looks like I will be getting short on the market next week. Wonder if we are going to inflate or deflate with the stimulus stuff and all?

I think gold can go up even in a deflationary time. It did in the 30's after going down first. I am long gold long term if you were wondering.

I think gold can go up even in a deflationary time. It did in the 30's after going down first. I am long gold long term if you were wondering.

Latest posts

-

-

-

Giardinetto di Totò Indoor... Settimana VIII Fio

- Latest: weedloverNa

Latest posts

-

-

-

Giardinetto di Totò Indoor... Settimana VIII Fio

- Latest: weedloverNa