sounds like fun to me.....yeehaw

-

Happy Birthday ICMag! Been 20 years since Gypsy Nirvana created the forum! We are celebrating with a 4/20 Giveaway and by launching a new Patreon tier called "420club". You can read more here.

-

Important notice: ICMag's T.O.U. has been updated. Please review it here. For your convenience, it is also available in the main forum menu, under 'Quick Links"!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

When the U.S. Dollar collapses how will MJ and food be affected?

- Thread starter Dreambig

- Start date

Ahhh, "digital dollars" vs "paper dollars"--there will always be a larger float of "digital dollars" than "paper dollars". It is the way the system operates.

To buy/sell US securities--the investor must have a bank account--as US Treasury does everything via "electronic transfer". Ditto with Social Security--no more "checks in the mail", now it is all "direct deposit" to the recipient's bank account. Most payroll is made via "direct deposit" and all those credit/debit card transactions are "digital dollars"...the vendor's bank account is credited with your purchase within a few days of the transaction--long before you receive the bill (which is also paid digitally--either online payment or check).

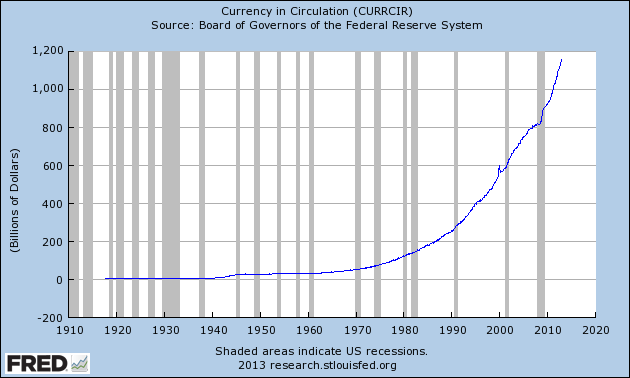

According to the FRB (Federal Reserve Board) for the week ending August 27, 2014 there is about $4.4 trillion dollars in the system--with just under $1.3 trillion in "paper dollars", the rest is all "digital". Source: http://www.federalreserve.gov/releases/h41/Current/

Nothing earth shattering...just biz as usual.

To buy/sell US securities--the investor must have a bank account--as US Treasury does everything via "electronic transfer". Ditto with Social Security--no more "checks in the mail", now it is all "direct deposit" to the recipient's bank account. Most payroll is made via "direct deposit" and all those credit/debit card transactions are "digital dollars"...the vendor's bank account is credited with your purchase within a few days of the transaction--long before you receive the bill (which is also paid digitally--either online payment or check).

According to the FRB (Federal Reserve Board) for the week ending August 27, 2014 there is about $4.4 trillion dollars in the system--with just under $1.3 trillion in "paper dollars", the rest is all "digital". Source: http://www.federalreserve.gov/releases/h41/Current/

Nothing earth shattering...just biz as usual.

Eclipse you are somewhat correct, but the proper way to view the money supply is also to include the reserves of credit waiting to be loaned out. It is considered money even if it never exits the printing press. For example checks going from the creditor to a depositor he may never actually take the cash and just leave it in the account and may use his credit cards to buy all his goods.

This is why we will have a currency collapse.

How a single dollar is created is through debt, a bond. The congress says it needs money and asks the treasury to write up some bonds which someone agrees to purchase with a expected rate of interest for being a creditor. It is through faith that they will be paid back in something that will not be devalued also.

This creditor can also be the federal reserve bank. Which it then uses to include in its reserves ,and then prints a dollar or credits a account in one of its banks.

So every dollar in circulation is actually a debt. Now we will see that the lending practices of the FED increases our initial debt without a bond being issued.

The Federal reserve can create money out of nothing by fractional lending. This is essentially counterfeiting. If you were to deposit 10 dollars the bank only has to keep 10% of it on deposit for demands. It then loans out 9 dollars by loan contracts to people whom are unsecured creditors. This seems like they would have increasingly less amounts of money to lend out by following that logic, but in reality they have counted their loans as assets and have put it in their reserves, so actually the have now 19 dollars in reserves to be loaned out again. So now they can loan out 90 percent of that with only 1.90 on hand for deposits. This process repeats itself. This can and does increase the amount in the money supply exponentially.

So now we see how the money supply increases, now its time to look at booms and busts and how they are created by the FED's intervention.

Essentially you have to look at money as you would any other good or service. Their is a supply and demand for it. Interest rates act to coordinate this in the form of a price over time in a free market without any intervention.

Lets look at this with only 3 actors. A bank, a business/borrower, a consumer/saver.

Banks pay depositors interest to make loans.

When the savers deposit their money in a bank and the banks reserves fill up they set interests rates low.

The business then see this as a signal to invest in a loan and along term project.

When the banks are low on reserves the interests rate are raised. So the cost of borrowing goes up and the business sees this and does not think it is the proper time to invest in any new projects.

The saver sees this high interest rate as a opportunity to put his money in the bank and get a good interest on his savings and the banks reserves are refilled.

When it is low the saver spends it now rather than later which compliments the business taking on a new investment just fine.

What the FED does is interjects itself in this mechanism by filling up the banks reserves which the bank then sets the interest rates low and the business takes on long term projects and expects profits from it. The saver spends his money rather than save it.It sounds good at first because this is what happens in a free market except this is artificial growth and the misallocation of resources.

1. There are limited resources on this earth so where the markets otherwise regulate this allocation of resources through supply and demand and is expressed in a price, there is a new artificial demand and competition increases between consumers and producers for those same scarce resources. There may not even be enough resources to complete the projects taken on by the producer. The prices rise as a result. This will increase the cost of the projects and consumer goods. This will result in layoffs or going out of business all together.

2. Resources get diverted and there is an oversupply. Typically certain businesses are favored like tech companies in the dot com bubble or any company related to housing in the real estate bubble. When there is a booming industry typically people may change professions causing a over supply of labor in their respective bubble fields. Perhaps this is a result of higher inflated wages in that field. This diverts them from professions where they would really be needed. This new over supply of prospective employees causes the wages to then drop and their may not be enough jobs for all of them creating unemployment.

3. At some point the FED then sees the boom and the rising prices in the bubble industry, the fed then raises the interest rates to combat it.

Consumers then begin to save more and decrease spending. The producers whom rely on the spending now have a high interest rate to pay and are in trouble.

People whom took out adjustable rate mortgages during the housing bubble will now need to save more because of the higher interest rate or they may default.

Another underlying factor is the businesses that started to support the new bubble economy. Existing business expanded and see losses during the deflation and new businesses started funded out of debt go out of business.

The banks who made these loans are also in trouble by the large number of defaults.

This boom was never sustainable and a recession follows, because it is the free market trying to correct things. The public sees it as an evil and the FED tries to fix it with more low interest rates which inflates the money supply and typically causes a new and bigger bubble.

Essentially the FED is introducing a monetary heroin the only thing it knows how to do, there is the high then the withdrawal.The short term is painful but has long term benefits so we need to just bite the bullet in order for a real recover to happen. This is the Austrian Business Cycle Theory in a nut shell.

Since this situation of short term pain for long term happiness is not going to happen with the current trends of deficit spending and unfunded liabilities the money supply is only going to increase, causing hyperinflation, and the destruction of our currency.

This is why we will have a currency collapse.

How a single dollar is created is through debt, a bond. The congress says it needs money and asks the treasury to write up some bonds which someone agrees to purchase with a expected rate of interest for being a creditor. It is through faith that they will be paid back in something that will not be devalued also.

This creditor can also be the federal reserve bank. Which it then uses to include in its reserves ,and then prints a dollar or credits a account in one of its banks.

So every dollar in circulation is actually a debt. Now we will see that the lending practices of the FED increases our initial debt without a bond being issued.

The Federal reserve can create money out of nothing by fractional lending. This is essentially counterfeiting. If you were to deposit 10 dollars the bank only has to keep 10% of it on deposit for demands. It then loans out 9 dollars by loan contracts to people whom are unsecured creditors. This seems like they would have increasingly less amounts of money to lend out by following that logic, but in reality they have counted their loans as assets and have put it in their reserves, so actually the have now 19 dollars in reserves to be loaned out again. So now they can loan out 90 percent of that with only 1.90 on hand for deposits. This process repeats itself. This can and does increase the amount in the money supply exponentially.

So now we see how the money supply increases, now its time to look at booms and busts and how they are created by the FED's intervention.

Essentially you have to look at money as you would any other good or service. Their is a supply and demand for it. Interest rates act to coordinate this in the form of a price over time in a free market without any intervention.

Lets look at this with only 3 actors. A bank, a business/borrower, a consumer/saver.

Banks pay depositors interest to make loans.

When the savers deposit their money in a bank and the banks reserves fill up they set interests rates low.

The business then see this as a signal to invest in a loan and along term project.

When the banks are low on reserves the interests rate are raised. So the cost of borrowing goes up and the business sees this and does not think it is the proper time to invest in any new projects.

The saver sees this high interest rate as a opportunity to put his money in the bank and get a good interest on his savings and the banks reserves are refilled.

When it is low the saver spends it now rather than later which compliments the business taking on a new investment just fine.

What the FED does is interjects itself in this mechanism by filling up the banks reserves which the bank then sets the interest rates low and the business takes on long term projects and expects profits from it. The saver spends his money rather than save it.It sounds good at first because this is what happens in a free market except this is artificial growth and the misallocation of resources.

1. There are limited resources on this earth so where the markets otherwise regulate this allocation of resources through supply and demand and is expressed in a price, there is a new artificial demand and competition increases between consumers and producers for those same scarce resources. There may not even be enough resources to complete the projects taken on by the producer. The prices rise as a result. This will increase the cost of the projects and consumer goods. This will result in layoffs or going out of business all together.

2. Resources get diverted and there is an oversupply. Typically certain businesses are favored like tech companies in the dot com bubble or any company related to housing in the real estate bubble. When there is a booming industry typically people may change professions causing a over supply of labor in their respective bubble fields. Perhaps this is a result of higher inflated wages in that field. This diverts them from professions where they would really be needed. This new over supply of prospective employees causes the wages to then drop and their may not be enough jobs for all of them creating unemployment.

3. At some point the FED then sees the boom and the rising prices in the bubble industry, the fed then raises the interest rates to combat it.

Consumers then begin to save more and decrease spending. The producers whom rely on the spending now have a high interest rate to pay and are in trouble.

People whom took out adjustable rate mortgages during the housing bubble will now need to save more because of the higher interest rate or they may default.

Another underlying factor is the businesses that started to support the new bubble economy. Existing business expanded and see losses during the deflation and new businesses started funded out of debt go out of business.

The banks who made these loans are also in trouble by the large number of defaults.

This boom was never sustainable and a recession follows, because it is the free market trying to correct things. The public sees it as an evil and the FED tries to fix it with more low interest rates which inflates the money supply and typically causes a new and bigger bubble.

Essentially the FED is introducing a monetary heroin the only thing it knows how to do, there is the high then the withdrawal.The short term is painful but has long term benefits so we need to just bite the bullet in order for a real recover to happen. This is the Austrian Business Cycle Theory in a nut shell.

Since this situation of short term pain for long term happiness is not going to happen with the current trends of deficit spending and unfunded liabilities the money supply is only going to increase, causing hyperinflation, and the destruction of our currency.

trout will now be worth 50$ a lb......biotches

Why do we have to wonder what will happen if the economy crumbles? And when we wonder why does it mostly seem to be dog eat dog scenarios.

If only we had some example of how people would react. History has shown there will be some suicides by the upper class who couldn't handle losing their wealth. A few more because the feel like a failure and can't provide.

There will be some murders and robberies. Some from desperation to feed family and most from the same scum that are around in good times too.

There will be death from starvation and disease (mostly young and elderly).

But for the most part people will suffer together and work together to get through it all.

Also the government will help us.

HOW DO I KNOW?

One worldwide example The Great Depression 1929-1939. We all made it through.

If only we had some example of how people would react. History has shown there will be some suicides by the upper class who couldn't handle losing their wealth. A few more because the feel like a failure and can't provide.

There will be some murders and robberies. Some from desperation to feed family and most from the same scum that are around in good times too.

There will be death from starvation and disease (mostly young and elderly).

But for the most part people will suffer together and work together to get through it all.

Also the government will help us.

HOW DO I KNOW?

One worldwide example The Great Depression 1929-1939. We all made it through.

Ahh Bentom, the way the US currency system works...is providing a supply of cash/currency/credit via banks...instead of directly going through the government. The people are customers of the bank...the banks are customers of the Feds (FRB).

Around the time of the Civil War, the US Government issued its first paper currency to pay for it's costs...the currency was a "note" but redeemable for gold coin. Within a few decades there was not just one "currency" used, but several were in general circulation, including US Notes, an assortment of national bank notes, and gold and silver certificates redeemable for coin. But a dollar was a dollar no matter which flavor you used..."note" or "certificate". Some bills allowed for the exchange for gold/silver--others were mere "promises"...allowing a dollar to buy a dollars worth of goods--no matter which flavor you used. A buck is a buck.

Now the system is based on "reserves" as you pointed out...the reserves is how the system operates...no hanky panky. When I make a deposit and let the money sit in my account....we agree I have access to my money, but it is part of the bank's "inventory" of cash. As in any business, having inventory is good--but selling your inventory is even better. The bank can not sell your money...but it can lend against it, and with help of the Feds (via capital/reserve requirements) banks lend your money to the guy next door.

Want to fuck up the system? Have every bank customer close their account and demand payment in cash. There is not enough gold in China to settle everyone's claim...much yet enough actual printed currency available. As a rule, banks keep very little cash on hand since the FRB technically warehouses the bank's cash.

This is where "faith" comes in...faith that all bank customers will not demand their cash at the same time, faith that borrowers will repay the bank, faith that one bank will accept another bank's financial instrument, faith that I can purchase a dollars worth of goods and services with a "note" issued by the Feds.

If one has never worked within the monetary system...I can see how skeptical one can be of it's operations. It is one crazy system--unlike that of any other country.

Around the time of the Civil War, the US Government issued its first paper currency to pay for it's costs...the currency was a "note" but redeemable for gold coin. Within a few decades there was not just one "currency" used, but several were in general circulation, including US Notes, an assortment of national bank notes, and gold and silver certificates redeemable for coin. But a dollar was a dollar no matter which flavor you used..."note" or "certificate". Some bills allowed for the exchange for gold/silver--others were mere "promises"...allowing a dollar to buy a dollars worth of goods--no matter which flavor you used. A buck is a buck.

Now the system is based on "reserves" as you pointed out...the reserves is how the system operates...no hanky panky. When I make a deposit and let the money sit in my account....we agree I have access to my money, but it is part of the bank's "inventory" of cash. As in any business, having inventory is good--but selling your inventory is even better. The bank can not sell your money...but it can lend against it, and with help of the Feds (via capital/reserve requirements) banks lend your money to the guy next door.

Want to fuck up the system? Have every bank customer close their account and demand payment in cash. There is not enough gold in China to settle everyone's claim...much yet enough actual printed currency available. As a rule, banks keep very little cash on hand since the FRB technically warehouses the bank's cash.

This is where "faith" comes in...faith that all bank customers will not demand their cash at the same time, faith that borrowers will repay the bank, faith that one bank will accept another bank's financial instrument, faith that I can purchase a dollars worth of goods and services with a "note" issued by the Feds.

If one has never worked within the monetary system...I can see how skeptical one can be of it's operations. It is one crazy system--unlike that of any other country.

Bloody hell man. I see one still needs a tin foil hat to enter the Tokers Den. I could give a 1000 educated logical reasons why the Dollar will not collapse in our life time. However, the bottom line is, billions of Chinese have tasted steak for the first time in 5000 years thanks to Americans buying all the rubbish they manufacture, and once a hungry China man taste steak, he will die before he goes back to eating brown puppy and rice. And always remember, in life never trust people who dislike dogs, RIF (reading is fundamental, buckle up for safety, just say yes to drug, and just say no to fear mongers.

I think it's logical and common sense to have a 'back-up plan' of sorts to some degree, and just have it in the back of your mind that shit can and will hit the fan at any moment, one way or another. Whether it be a riot outside your front door, natural disaster of continental proportions or, in fact, economic collapse.

But I'm not going to waste too much of my time on this planet worrying about it...

Cheers.

But I'm not going to waste too much of my time on this planet worrying about it...

Cheers.

Ahh Bentom, the way the US currency system works...is providing a supply of cash/currency/credit via banks...instead of directly going through the government. The people are customers of the bank...the bank is the customer of the Feds (FRB).

I explained why that was counterfeiting. Bonds issued by the tresury vs fractional reserve lending based on nothing but their private policy.

Around the time of the Civil War, the US Government issued its first paper currency to pay for it's costs...the currency was a "note" but redeemable for gold coin. Within a few decades there was not just one "currency" used, but several were in general circulation, including US Notes, an assortment of national bank notes, and gold and silver certificates redeemable for bullion .

Yes greenbacks were supposed to pay for the civil war. They were not redeemable though. They were credit (debt) based and the competing notes were state notes not national.

Definition of 'Greenback'

A slang term for U.S. paper dollars. Greenbacks got their name from their color, however, in the mid-1800s, "greenback" was a negative term. During this time, the Continental Congress did not have taxing authority. As a result, the greenbacks did not have a secure financial backing and banks were reluctant to give customers the full value of the dollar.

It took half a century to get all the foreign coins and competing state currencies out of circulation,

But a dollar was a dollar no matter which flavor you used..."note" or "certificate". Some bills allowed for the exchange for gold/silver--others were mere "promises"...allowing a dollar to buy a dollars worth of goods--no matter which flavor you used. A buck is a buck.

Nope a dollar is a weight of measure like a foot or a pound. Any note supposed to be a dollar was just a promise to pay a dollar weight in gold or silver. A note with nothing to back it was insolvent and based on a government decree. I wouldn't recommend taking IOUs from insolvent debtors.

Now the system is based on "reserves" as you pointed out...the reserves is how the system operates...no hanky panky. When I make a deposit and let the money sit in my account....we agree I have access to my money, but it is part of the bank's "inventory" of cash. As in any business, having inventory is good--but selling your inventory is even better. The bank can not sell your money...but it can lend against it, and with help of the Feds (via capital/reserve requirements) banks lend your money to the guy next door.

This is a lot of conflation. I don't think you know what you are talking about. Yes banks operate by having people store their cash and making loans. But if I were to hold your cash and loan out 90% of it I think you would be a little worried. If the government helped me loan out 90% of it I don't think it would calm you fears. If the FDIC was completely underfunded I think you would worry more. If I told you they were there to make sure I was solvent and not you, you would withdraw your money completely.

Want to fuck up the system? Have every bank customer close their account and demand payment in cash. There is not enough gold in China to settle everyone's claim...much yet enough actual printed currency available. As a rule, banks keep very little cash on hand since the FRB technically warehouses the bank's cash.

This is where "faith" comes in...faith that all bank customers will not demand their cash at the same time, faith that borrowers will repay the bank, faith that one bank will accept another bank's financial instrument, faith that I can purchase a dollars worth of goods and services with a "note" issued by the Feds.

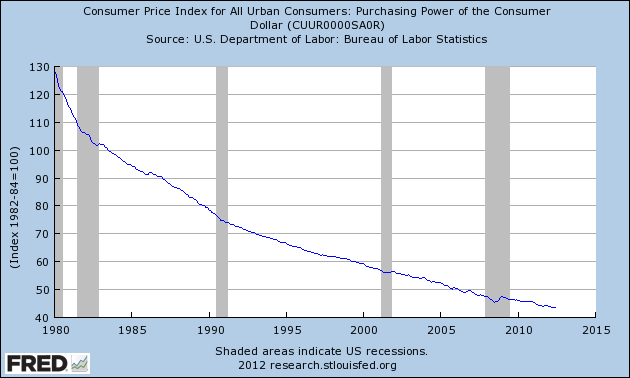

OK so I am thinking you agree they are insolvent. With regard to gold/silver never mind more paper.

There is a zero chance of redeeming your paper fiat in precious metals, since that is what making good on one of those notes includes. Since Nixon collapsed the Brenton woods agreement in 71. The redemption of the dollar to gold ended then. If you have faith in people who make promises to pay you in precious metals then tell you, you will only receive more paper, you have problems. The "dollar is being devalued with every new one printed. A dollar worth of goods in the seventies is totally different than now. There is no reason to have any faith in it. Look what happened when they completely divorced from gold in 71.

If one has never worked within the monetary system...I can see how skeptical one can be of its operations. It is one crazy system--unlike that of any other country.

There is a definite difference between money and currency. Responsible lending on a private level vs irresponsible lending from private institutions with the help of government.

LOL...Bentom, sometimes wiki will backfire on you with bullshit. So lets correct your first mistake regarding the "demand notes" aka "greenbacks" and your claim that they were not redeemable.

"In 1862, the U.S. Treasury placed into circulation its first paper currency, Demand notes, to help finance the Civil War. Printed in $5, $10, and $20 denominations, Demand notes – also known as “greenbacks” – were redeemable in coin on demand."

Source: http://www.frbsf.org/education/teacher-resources/american-currency-exhibit/civil-war-3

As to your other opinions...I respect them, but disagree.

BTW...money is "coin and currency"....does not include one's available debt/credit. And..."coins" are not "currency"--which means "coins" are not "notes". "Coins" are obligations of the US Treasury and "notes" (currency) are obligations of the Federal Reserve (FRB)--two different monsters.

Now we are in the weeds, lol....smoke a fatty and all will be better.

"In 1862, the U.S. Treasury placed into circulation its first paper currency, Demand notes, to help finance the Civil War. Printed in $5, $10, and $20 denominations, Demand notes – also known as “greenbacks” – were redeemable in coin on demand."

Source: http://www.frbsf.org/education/teacher-resources/american-currency-exhibit/civil-war-3

As to your other opinions...I respect them, but disagree.

BTW...money is "coin and currency"....does not include one's available debt/credit. And..."coins" are not "currency"--which means "coins" are not "notes". "Coins" are obligations of the US Treasury and "notes" (currency) are obligations of the Federal Reserve (FRB)--two different monsters.

Now we are in the weeds, lol....smoke a fatty and all will be better.

LOL...Bentom, sometimes wiki will backfire on you with bullshit. So lets correct your first mistake regarding the "demand notes" aka "greenbacks" and your claim that they were not redeemable.

"In 1862, the U.S. Treasury placed into circulation its first paper currency, Demand notes, to help finance the Civil War. Printed in $5, $10, and $20 denominations, Demand notes – also known as “greenbacks” – were redeemable in coin on demand."

Source: http://www.frbsf.org/education/teacher-resources/american-currency-exhibit/civil-war-3

As to your other opinions...I respect them, but disagree.

BTW...money is "coin and currency"....not debt/credit. And..."coins" are not "currency"--which means "coins" are not "notes".

Now we are in the weeds, lol....smoke a fatty and all will be better.

Ok well that changed over time. At one time they were non redeemable and purely fiat.

Gale Encyclopedia of U.S. Economic History | 1999 | Copyright

GREENBACKS

Greenbacks were the paper money printed and issued by the U.S. government during the American Civil War (1861–65). The financial demands of the war quickly depleted the nation's supply of specie (gold and silver). In response the government passed the Legal Tender Act of 1862, which suspended specie payments and provided for the issue of paper money. About $430 million in notes were issued. The notes were legal tender—money that had to be accepted in payment of any debt. Because the bills were supported only by the government's promise to pay, it was somewhat derisively observed that the bills were backed only by the green ink they were printed with on one side. (Hence the name greenbacks.) The value of the notes depended on the peoples' confidence in the U.S. government and its future ability to convert the currency to coin. As the fighting between the Union and the Confederacy raged, confidence in government fluctuated: When the Union suffered defeat, the value of the greenbacks dropped—one time to as low as 35 cents on the dollar.

Greenbacks remained in circulation after the fighting ended; they finally regained their full value in 1878. After the financial crisis in 1873, many people— particularly western farmers—clamored for the government to issue more. Advocates of the monetary system formed the Greenback Party, which was active in U.S. politics between 1876 and 1884. The party believed that by putting more greenbacks into circulation, the U.S. government would make it easier for debts to be paid and prices would go up—resulting in prosperity. At the end of the twentieth century, the system of paper money remained based on the government's issue of notes (greenbacks), which was made necessary by the Civil War.

Greenback

Greenback was officially the United States note, first issued by the U.S. Treasury in 1862 as legal tender fiduciary paper money to help finance the Civil War. Their value in gold at one time (1864) was below 40 cents. In 1879, they became redeemable in gold. However, when the United States went off the gold standard in 1933, the greenbacks again became irredeemable. The highest amount outstanding was $450,000,000.[1]

See also: U.S. dollar

Ok I think you are almost there. MONEY is commodity money chosen by the free market. By law the founders recognized it as being the only money worthy to transact in ( the constitution) ( Coinage act of 1792).

Dollars or Units

A promise to pay in gold and silver is NOT MONEY. It is just a piece of paper, a currency to be redeemed in gold and silver. A debt. Legal tender by law, but it does not make it money by definition just fiat.

Ok well that changed over time. At one time they were non redeemable and purely fiat....

LOL...nothing changed overtime--those first notes were redeemable for coin (period), what happened to their valuation afterwards is a different story. Seems the stories/history you were told are a bit different than what really happened. History seems to re-write itself when the facts do not agree with one's opinion; its not your fault--it happens all the time. Not all teachers are knowledgeable on the topics they teach...especially when it comes to history--I blame it on the public education system.

BTW...if you want your legal tender (money) to be in a form where the metal content of the coin is equal to or greater than the face amount--go hoard all the pre-1983 pennies. With a copper content of 95% their "melt down value" is worth $0.021. Pennies issued now contain only 2.5% copper and cost about 2.5 cents to make--not worthy of hoarding.

Nope, I will take "paper dollars", aka "currency" or as you call the "fiat dollars" to pay for my goods and services (easy to carry a few thousand of those "fiat dollars" in my pocket)--and peeps like you that want "real money" can use wheel barrels to haul their pre-1983 copper pennies.

Guess we have nothing to fear...but fear itself, the calamity you espouse is...IMHO, created by those with a funny agenda--like selling "fear" in all sorts of things: books, precious metals ("like the feel of gold?"....crazy TV commercials, LOL), prepper gear (complete with camo wife beater shirts...lol), etc.

IMHO, greater chance of Solar Storm damaging our electronic infrastructure.....than the US Dollars becoming worthless. Less "if's" for the disaster to happen.

LOL...nothing changed overtime--those first notes were redeemable for coin (period), what happened to their valuation afterwards is a different story.

Respectfully I think you are picking and choosing which parts of my post to ignore and history. If you want, find a greenback if you can and try to redeem it, or any bank note for that matter i think you will find it is not going to happen. That would be its redemption changing over time. Then vs now.

BTW...if you want your legal tender (money) to be in a form where the metal content of the coin is equal to or greater than the face amount--go hoard all the pre-1983 pennies. With a copper content of 95% their "melt down value" is worth $0.021. Pennies issued now contain only 2.5% copper and cost about 2.5 cents to make--not worthy of hoarding.

Legal tender is different than money my friend. By definition.

I buy silver eagles they are worth a dollar ,always have been, always will be. Because a dollar is a weight of measure in silver. We pay around 20 paper dollars for them now. I is because the purchasing power of the paper has gone down.

Guess we have nothing to fear...but fear itself, the calamity you espouse is...IMHO, created by those with a funny agenda--like selling books, precious metals ("like the feel of gold?"....crazy TV commercials, LOL) or prepper gear (complete with camo wife beater shirts...lol).

IMHO, greater chance of Solar Storm damaging our electronic infrastructure.....than the US Dollars becoming worthless. Less "if's".

That's funny since every fiat currency as in existence has been destroyed at one time or another and usually within short order of being introduced relatively speaking. Gold and silver have been money for thousands of years, that would be one hell of a gimmick to pull off it was one.

[YOUTUBEIF]2Dj9v9s9buk[/YOUTUBEIF]

I think we can agree....to disagree.

If the dollar were to completely collapse, (ie.: it takes a wheelbarrow full of "Federal Reserve Jokes" to buy a loaf of bread), then the only way you can be prepared is to have things of value that you can trade to your neighbors (or anyone else near you).

This could be MANY diferent things: silver, gold, food, clean water, bullets, weed, booze, toilet paper, gasoline or even toothpics...

As long as it is something your neighbor wants or needs, and is willing to accept, for something that he has, that YOU want or need.

This could be MANY diferent things: silver, gold, food, clean water, bullets, weed, booze, toilet paper, gasoline or even toothpics...

As long as it is something your neighbor wants or needs, and is willing to accept, for something that he has, that YOU want or need.

If the dollar were to completely collapse, (ie.: it takes a wheelbarrow full of "Federal Reserve Jokes" to buy a loaf of bread), then the only way you can be prepared is to have things of value that you can trade to your neighbors (or anyone else near you).

This could be MANY diferent things: silver, gold, food, clean water, bullets, weed, booze, toilet paper, gasoline or even toothpics...

As long as it is something your neighbor wants or needs, and is willing to accept, for something that he has, that YOU want or need.

salt will ALWAYS be in demand. that is what the Roman Legions were partially paid with, as their word for salt was the grammatical root for the word "salary"... you HAVE to have a certain amount in your food, you can cure meat with it, it's just plain useful.

The unfortunate truth here is that such an economic disaster - and we are currently experiencing one - is very politically difficult to survive and the culprits easily identified.

Which is why it probably won't happen.

Instead a large war will occur - as typically has happened in history - to cover up this problem and focus peoples attention elsewhere.

See: What is happening in the Ukraine and elsewhere.

Also worth noting is Chinese real estate is currently bottoming out and it's not a good sign for the rest of us economically speaking. It could be looked at like the major disaster the OP has spoken about is already happening (although how it exactly unfolds is debated by many very intelligent people, some say inflation some say deflation either way it's bad) and we're only going to see the war drums escalate as a result.

Which is why it probably won't happen.

Instead a large war will occur - as typically has happened in history - to cover up this problem and focus peoples attention elsewhere.

See: What is happening in the Ukraine and elsewhere.

Also worth noting is Chinese real estate is currently bottoming out and it's not a good sign for the rest of us economically speaking. It could be looked at like the major disaster the OP has spoken about is already happening (although how it exactly unfolds is debated by many very intelligent people, some say inflation some say deflation either way it's bad) and we're only going to see the war drums escalate as a result.

Some things to ponder over and wonder why the number 14 is so hot.

The value of all the privately owned real estate in the US is just over $14 trillion.

The value of all the US stock markets is just over $14 trillion.

The debt of the US Government is just over $14 trillion.

The value of all the privately owned real estate in the US is just over $14 trillion.

The value of all the US stock markets is just over $14 trillion.

The debt of the US Government is just over $14 trillion.

Some things to ponder over and wonder why the number 14 is so hot.

14 is the age at which most girls voices change....from "no" to "yes"...