You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short term trades in the stock market •$$$$$•

- Thread starter TNTBudSticker

- Start date

Presenting the crunch in liquidity crunch. Tomorrow should be a hoot.

Cue Panic As Fed Resumes Liquidity Swap Lines, Lends $200 Million To Swiss National Bank, Most Since October 2010

Cue Panic As Fed Resumes Liquidity Swap Lines, Lends $200 Million To Swiss National Bank, Most Since October 2010

If yesterday's news broken by ZH that one bank was in dire need of US dollars and ended up borrowing $500 million from the ECB was enough to send the market down almost 5% today, then the follow up news that the FRBNY just reactivated FX swap lines with Europe will likely send ES limit down at tomorrow's open. The FRBNY has just announced that in the week ended August 17, it lent out $200 million to not the ECB, not the BOE, but the "most stable" of all banks: the SNB. This is the first use of the Fed's Swap Lines since March, and the most transacted under this "last ditch global bailout swap line" (see more on how the Fed bailed out the world using swap lines here) since October 2010. This event also gives us a hint that the European bank in question in dire need of cash is Swiss, which in turn means that it is not some usual PIIGS suspect, but one of the two "big ones." If true, this means that the European insolvency, liquidity and what have you crisis is about to take an exponential step function higher.

HPQ After Hours: $26.75 -$2.76

Nice Short to Hold.

Nice Short to Hold.

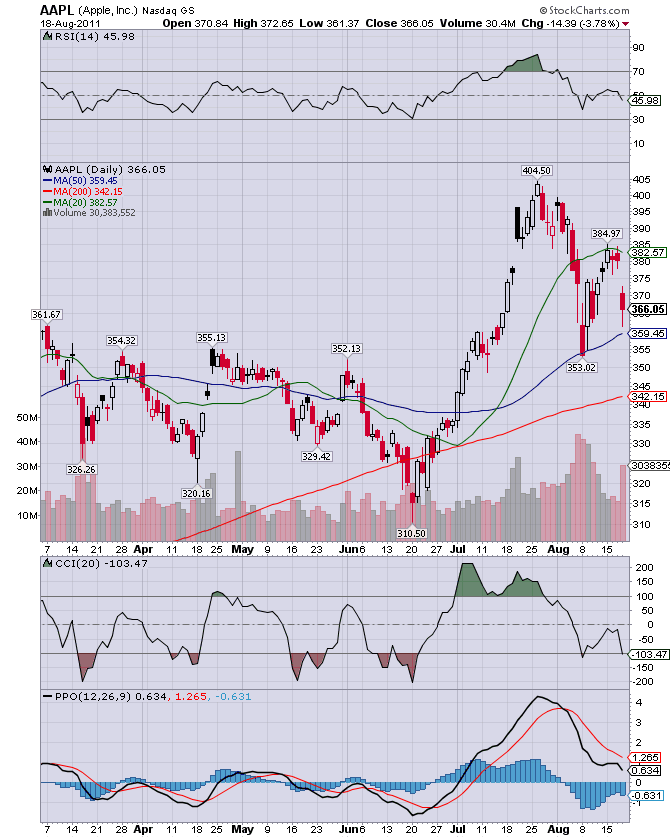

last two days AAPL was a short , almost 98% risk free @ the 20ma overhead R @ $384...

ANF paying Jersey Shore's "The Situation" not to wear their clothes , what more rediculous....its a tough stock to short but was all the way today to $64's support but looks at risk still

NTAP taken out to the shed tonight

This was a giving it away all week , AAPL was hitting a wall up at the 20ma abd that stall was palpable & easy short ... with Gold popping , DELL& NTAP earnings misses and now HPQ ...

There was also some scalps long off $366 for AAPL intraday but then swoon at the EOD took it down to the 50ma @ $360 . There was another scalp long off that dip where the SPX retested 1130 and again EOD bounce. AAPL closed up $367 ...

NTAP DELL JDSU were continuation shorts as was ANF ...

Last edited:

.

As the Euro banks find themselves teetering on the brink with the Italian & Spanish bond crisis (check BCS hart, Barclay's owns $9bil of Spain debt ) here's that H&S chart which took all but a week to play out down to the lower target zone of 1165 as market bounced to 1220 early on Euro rescue (bah!) but sold off unhappy with fears of a US downgrade & still weak jobs.

Again BCS & the euro banks really took it hard down 14% and looking like one of them is about ready to do a 2008 . Have to keep them on watch cause they bounced hard last time & see what levels hold tomorrow ....they've been taking down 30% since 1rst of aug

http://stockcharts.com/h-sc/ui?s=BCS&p=D&b=5&g=0&id=p40890212192

SPX tried to hold that 1130 level but anything can go wrong taking it down to 1060 later yet , being on watch for any bounces still in the cards to

Lucky they banned short selling or the Euro scene could have been a disaster. Oh wait, it was a disaster! This is like a sinking ship bursting a new hole every few weeks. Get one fixed and another appears soon.

Wish I had of bought more gold at $400, oh well at least I have some. If this same game of 'who is the weak link today' continues you could see $2500 gold real soon.

Wish I had of bought more gold at $400, oh well at least I have some. If this same game of 'who is the weak link today' continues you could see $2500 gold real soon.

C

CascadeFarmer

Since that ban was for banks/financials only there was still a lot of short selling going on elsewhere over there. It was/is a disaster and still unfolding. They've only slowed it down and delayed things a little bit.Lucky they banned short selling or the Euro scene could have been a disaster.

AUY making up quickly for yesterday's losses and RIC holding up very well so far.

Did Someone Just Leak QE3? USDJPY Plunges To Fresh All Time Low 75.95, Stocks Soar

Currency wars like a mofo. Pushing Japan into the abyss.

Yen surges, USDJPY plunges to a new record low of 75.97 (yes, YNoda is looking, looking, looking although better word is panicking, panicking, panicking), and the ES soared promptly. So... did someone finally leak it? Does the market still not get that it has to be lower the day of Jackson Hole for QE3 to work? Frontrunning any QE3 announcement merely makes it redundant. Bernanke needs stocks around 1000 on August 26, not higher. In the meantime, buy that Sony flat screen today. At this rate of Yen appreciation, the company may not exist in a few months.

USDJPY near all time record low;

And ES kneejerk:

Currency wars like a mofo. Pushing Japan into the abyss.

Interactive Brokers is warning of imminent margin hikes on gold. Get ready to buy the fucking dip and then watch it take off even higher after the central planner's next failed attempt to control the price of the shiny metal and maintain the illusion of stable fiat.

Looks like we are going to shit the bed going into the close. All indices down ~1% and tanking hard.

Looks like we are going to shit the bed going into the close. All indices down ~1% and tanking hard.

C

CascadeFarmer

Good info. If that does happen would agree. Stocks like AUY and RIC would probably get hit pretty hard but I'm thinking buying opportunities if you wanna hold equities. AUY in overbought territory anyway. I'm looking for a pullback here or pretty soon.Interactive Brokers is warning of imminent margin hikes on gold. Get ready to buy the fucking dip and then watch it take off even higher after the central planner's next failed attempt to control the price of the shiny metal and maintain the illusion of stable fiat.

Here's an interesting chart...Ruger...guns...been on a nice Bull run for a few years. Lot's of people buying guns but I'm sure the company is also run pretty well. Look at a weekly chart! The recent correction was barely a hiccup. All buying and virtually no selling for months. I'd rather have a different make but still. Not in overbought territory but a bit of a stretch here IMO. Very strong with its 20 MA pushing it up. Cleared old resistance in a 4 year base a few months ago at around $23.00.

Gold, Silver, Brass, Ass, and Grass. All you need to be good to go.

Here is the release.

Here is the release.

Interactive Brokers bulletin board

To HKFE,HKMEX,NYMEX,NYSELIFFE traders:

Fri Aug 19 13:29:35 2011 EST

As a result of the volatile trading environment at the present

time, please be advised that Exchange margins and House margins are

likely to increase over the next couple of days. For exchange-

specific increases, please visit the respective websites. IB will

also be increasing the gold derivatives margin. Please monitor any

affected holdings closely and manage your risk accordingly.

C

CascadeFarmer

Right now gold looks even more over extended than silver before it crashed recently. Looks like a climax top of sorts similar to the climax top for silver. The chart patterns are very close with gold being more exaggerated at this point compared to where silver was late April. I'm tempted to short it! Looks like some peeps ready to get scalped. It's accelerated way above it's accelerating 20 MA. I don't think it's sustainable but that's just an opinion. Seems it needs to come back to earth a bit. Here's a silver and gold comparo...Gold, Silver, Brass, Ass, and Grass. All you need to be good to go.

C

CascadeFarmer

QQQ will experience a new recent closing low and not close to being oversold. It's searching for a bottom that I think is a ways away. Seems gold is peaking a bit in an overbought/extended situation. QQQ 50 MA has crossed below it's now flat 200 MA.

Cramer and other talking heads have been recently/are pushing gold hard. Not good IMO. Some sort of correction must be coming.

I'm thinking this. I believe QE3 is still priced in. If we don't get S&P 1000 by Jackson Hole and there is no QE3 I think everything crashes hard. Real hard. Like these past few weeks was nothing hard. Gold including. If the pundits are pushing the herd into gold there must be a mini-slaughter coming. After everything tanks and the market almost dies due to withdrawal symptoms. Bernanke will come out with QE3. Then we take off again. We'll see.

After everything tanks and the market almost dies due to withdrawal symptoms. Bernanke will come out with QE3. Then we take off again. We'll see.

Dow down -173 today on another volatile day. Next week is Jackson Hole week. Should be good.

I'm thinking this. I believe QE3 is still priced in. If we don't get S&P 1000 by Jackson Hole and there is no QE3 I think everything crashes hard. Real hard. Like these past few weeks was nothing hard. Gold including. If the pundits are pushing the herd into gold there must be a mini-slaughter coming.

After everything tanks and the market almost dies due to withdrawal symptoms. Bernanke will come out with QE3. Then we take off again. We'll see.

After everything tanks and the market almost dies due to withdrawal symptoms. Bernanke will come out with QE3. Then we take off again. We'll see.Dow down -173 today on another volatile day. Next week is Jackson Hole week. Should be good.

C

CascadeFarmer

Fucked up and didn't get my orders in before the close. The 'system' bogged down near the end. Either a blessing in disguise or I missed a good opportunity...lol. We'll see what Monday brings!

C

CascadeFarmer

SELL SELL SELL and not BUY BUY BUY! Anyway if not Monday a short term top in gold is around the corner. Could be up for a pretty decent correction though. Seems like take some scalps time like silver awhile back.Cramer and other talking heads are pushing gold hard right now. Not good IMO.

Cramer is sell sell sell on gold? I missed that. Thanx. He was screaming sell the banks too yesterday which I found interesting considering he was cheerleading for Lehman right before it collapsed.

C

CascadeFarmer

No he's BUY BUY BUY gold. Cramer is a decent contrary indicator like he was with B of A and other things.Cramer is sell sell sell on gold? I missed that. Thanx.

In other news...

That's 1 in 4 households.SAN FRANCISCO -- One in four California households with children reported food hardship, according to a new analysis of Gallup data released last Thursday by the Food Research and Action Center (FRAC).

“It’s disturbing, but not surprising,” said Kelly Hardy, director of health policy at Children Now.

The report analyzed data gathered as part of the Gallup-Healthways Well-Being Index project’s responses to the question: “Have there been times in the past 12 months when you did not have enough money to buy food that you or your family needed?”

“It sends a clear signal of economic distress, particularly for families with children,” noted James Weill, president of FRAC. “The answers to the question reveal there are times that these families are going without eating a meal, or the parents are skipping a meal for their children, or children are skipping meals.”

California had the second highest number of metropolitan areas with rates of food hardship in households with children in 2009-2010, according to the report.

Cramer is a carnival barker, but I use him to make money.

Yesterday he had the CEO of SODA on, and knowing this, I bought 1000 shares in aftermarket, 2 hours before the show.

CEO pumped his product as expected, and stock shot up over $3 this morning. I sold near the highs, and went short. It dropped $5 from it's high, so I made $7 per share, all thanks to Cramer.

Just amazing the power this guy has!

Sheeple by the millions actually listen to what he says and act on it.

Incredible!

Yesterday he had the CEO of SODA on, and knowing this, I bought 1000 shares in aftermarket, 2 hours before the show.

CEO pumped his product as expected, and stock shot up over $3 this morning. I sold near the highs, and went short. It dropped $5 from it's high, so I made $7 per share, all thanks to Cramer.

Just amazing the power this guy has!

Sheeple by the millions actually listen to what he says and act on it.

Incredible!

C

CascadeFarmer

That's the power of the 'Cramer'. Him pumping gold at this point IMO is to create a situation where the mass of sheeple buy in to let the fatted cows take some profits then the sheeple will get slaughtered. Taking the whole 'gold is savior' thing away it's pretty overbought technically and the chart is looking like crap for those wanting to or making an entry on the long side. The chart looks like it's on steroids and for long term physical holders fine otherwise prepare to take a beating...IMO.Sheeple by the millions actually listen to what he says and act on it. Incredible!

Gold right now reminds me a lot of silver back in April but on steroids.

I'm thinking about creating a Cramer Index...LOL!

'Sheeple'...I think we can get that into the next round of acceptable new words...'sheeple'...vote for it when you can!