There have been a few threads talking about the economy, asking what the financial future holds, what to do...etc.

This is a link to another site...Zero Hedge...It's about an investment company FINALLY telling the truth on national TV. He says that the markets are done...the only one still investing in bonds and stocks is the federal government. It's worth the watch. I'll c&p some of the words...but you need to watch the video.

http://www.zerohedge.com/article/af...trimtabs-still-cant-find-who-doing-all-buying

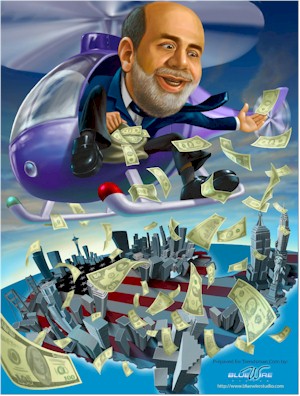

"A year after Charles Biderman's provocative post first appeared on Zero Hedge, in which he asked just who is doing all the buying of stocks as the money was obviously not coming from retail investors (and came up with one very notable suggestion), today Maria Bartiromo invited the TrimTabs head once again (conveniently on CNBC's lowest rated show, during Christmas Eve...eve, at a time when perhaps 5 people would be watching) in an interview which disclosed that after more than a year of searching, Biderman still has no idea who is actually buying. In response to Bartiromo's question if the retail investor, who left after the flash crash (thank you SEC), Biderman responds what every Zero Hedger has known for 33 weeks: "Retail investors are not coming back to the US. Those investors that are investing are buying global equities and are buying commodities. We are seeing lots money going into commodity ETF funds: gold, silver..." and the even more unpleasant summation: "individuals have been selling, companies are net selling, insider selling and new offerings are swamping any buyback and any cash M&A activity since QE 2 was announced. Pension funds and hedge funds don't really have that much cash to invest. So what nobody's asking is what happens when QE 2 stops: if the only buyer is the Fed, and the Fed stops buying, I don't know what is going to happen...When I was on your show a year ago I was saying the same thing: we can't figure out who is doing the buying it has to be the government, and people said I was nuts. Now the government is admitting it is rigging the market." Cue Bartiromo jaw dropping.

As for the simple math of where the money is actually going:

"Money flows come out of income, take home pay of everybody plus money that came from real estate is down about $1 trillion a year. It peaked in the 3rd quarter of 2008, at $7 trillion, that's take home pay for everybody who pays taxes plus the money that came from real estate. It has now bottomed at $5.9 trillion. We are still down $1.1 trillion in money that people have to spend each year, that's 16%. And some of the money that is leaving equity markets we think is going to pay bills."

Much more CNBC non-grata truthiness in the full clip, in which Biderman suggest what Zero Hedge readers realized over a month ago, that in June QE3 will likely have at least a partial municipal bond focus. "

This is a link to another site...Zero Hedge...It's about an investment company FINALLY telling the truth on national TV. He says that the markets are done...the only one still investing in bonds and stocks is the federal government. It's worth the watch. I'll c&p some of the words...but you need to watch the video.

http://www.zerohedge.com/article/af...trimtabs-still-cant-find-who-doing-all-buying

"A year after Charles Biderman's provocative post first appeared on Zero Hedge, in which he asked just who is doing all the buying of stocks as the money was obviously not coming from retail investors (and came up with one very notable suggestion), today Maria Bartiromo invited the TrimTabs head once again (conveniently on CNBC's lowest rated show, during Christmas Eve...eve, at a time when perhaps 5 people would be watching) in an interview which disclosed that after more than a year of searching, Biderman still has no idea who is actually buying. In response to Bartiromo's question if the retail investor, who left after the flash crash (thank you SEC), Biderman responds what every Zero Hedger has known for 33 weeks: "Retail investors are not coming back to the US. Those investors that are investing are buying global equities and are buying commodities. We are seeing lots money going into commodity ETF funds: gold, silver..." and the even more unpleasant summation: "individuals have been selling, companies are net selling, insider selling and new offerings are swamping any buyback and any cash M&A activity since QE 2 was announced. Pension funds and hedge funds don't really have that much cash to invest. So what nobody's asking is what happens when QE 2 stops: if the only buyer is the Fed, and the Fed stops buying, I don't know what is going to happen...When I was on your show a year ago I was saying the same thing: we can't figure out who is doing the buying it has to be the government, and people said I was nuts. Now the government is admitting it is rigging the market." Cue Bartiromo jaw dropping.

As for the simple math of where the money is actually going:

"Money flows come out of income, take home pay of everybody plus money that came from real estate is down about $1 trillion a year. It peaked in the 3rd quarter of 2008, at $7 trillion, that's take home pay for everybody who pays taxes plus the money that came from real estate. It has now bottomed at $5.9 trillion. We are still down $1.1 trillion in money that people have to spend each year, that's 16%. And some of the money that is leaving equity markets we think is going to pay bills."

Much more CNBC non-grata truthiness in the full clip, in which Biderman suggest what Zero Hedge readers realized over a month ago, that in June QE3 will likely have at least a partial municipal bond focus. "