St. Phatty

Active member

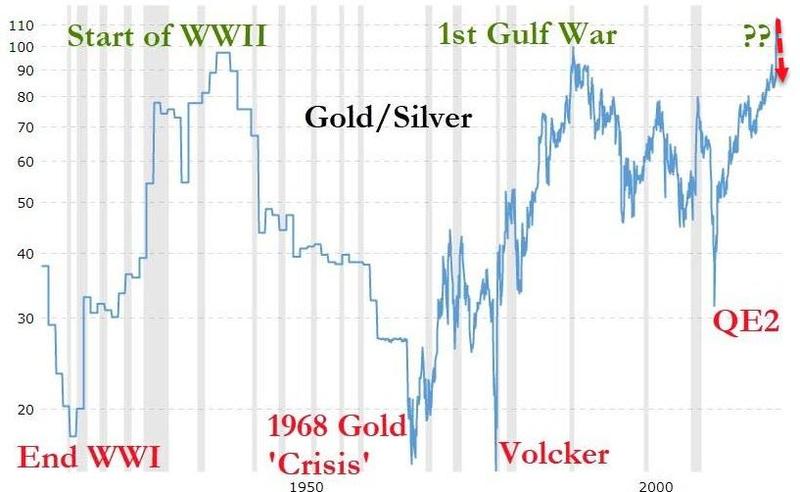

it was always going to happen eventually.

when it's going up $1 an ounce a day ...

wouldn't it be nice to be an insider in this industry. i.e. in the Fed/ Treasury currency management groups.

note how the percentage of increase is much greater when the price is low.

up $1 today is like up $2 when it's $40 an ounce.

when it's going up $1 an ounce a day ...

wouldn't it be nice to be an insider in this industry. i.e. in the Fed/ Treasury currency management groups.

note how the percentage of increase is much greater when the price is low.

up $1 today is like up $2 when it's $40 an ounce.