St. Phatty

Active member

https://finance.yahoo.com/quote/DB?p=DB&.tsrc=fin-srch

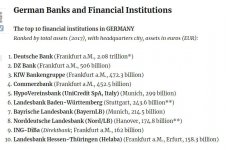

A Trillion Dollar Bank with a stock market cap of $14 Billion.

A Trillion Dollar Bank whose stock market cap is lower now (Now, Today) than during the worst parts of 2007/8/9.

What'sa going on ?

Does it mean anything ?

It meant something in 2008. I had an account with Washington Mutual, and it was by studying the stock price that I got worried enough to drive 600 miles, to close the account.

I closed the account Saturday September 20, 2008. WaMu ceased to exist on Thursday, September 25, 2008. There was about $20K involved, and for me that's a lot of money.

I had zero assurance of anything.

As it turned out, the bankrupt corpse of WaMu was assigned to JP Morgan Chase. JPM paid about $1.5 Billion to somebody for the privilege of inheriting a whole bunch of bank branches and customers.

The US government (i.e. the tax-payer) took on all of the value-less and high-risk credit derivatives, from WaMu. It was the ownership of those credit derivatives that was part of the story of WaMu going down.

Ever since then I have been a believer in using stock market cap to provide information - on the downside.

The bubble companies like Uber, WeWork, SalesForce ... a separate subject. It is WIERD that they have higher stock market caps than Deutsch Bank.

A stock price of $60 would give Deutsch Bank a market cap of $124 Billion.

The market cap @ $14 Billion is an indication that the market thinks Deutsch Bank has a $110 Billion problem.

Anyway, I think the next 3 to 6 months will be very interesting for Deutsch Bank.