N

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Short term trades in the stock market •$$$$$•

- Thread starter TNTBudSticker

- Start date

good sell off today, I missed out on it, however I did make $300 on the first initial pop after the sell off. I had reached my goal before it happened and started doing other things and when I showed up, I was like DAYUM. So I just had to watch for a bit and doubled my profits for the day.

If you subscribe to RussiaToday on youtube you get those videos from Max Keiser a few times a week, he is so funny. He knows whats up too when it comes to the financial system and its corruption.

If you subscribe to RussiaToday on youtube you get those videos from Max Keiser a few times a week, he is so funny. He knows whats up too when it comes to the financial system and its corruption.

Kinda bad for the bears if there is a ban on short-selling.It's for some tasty news thou.Will it work for maybe 15-30 minutes for the Bulls?...

I'm still hanging around the 400 Level and got 33 points today with Shorting 3 silver stocks and oil.I re-added Netflix since it's reporting after Monday's close..Shorted it at $165-$119.Got alot of points so hopefully,Netflix did cause alot of damage with the price increase so we'll find out.Some stocks seems to be on the bottom of a cycle like SKF.I made be just lucky to get out of them and get the points lost.

I did something cool today,,,After hearing about Copper's Decline from the $4.65 (high) level with $1.25 (low) and now at $3.20 Spot.(61% seems bullish on copper and 19%-19% were undecided and bearish) and I went out and got some Copper Bars by the Pound and two 1/2 Pounders.For $25.00 with shipping.I don't mean to spam anyone's website but the website looked good and I'm waiting for delivery.If it goes down in price...I'll get more for fun and I'll be waiting on the housing to recover in case copper is needed. On the other hand..Does this mean also Gold will drop too? Is Copper the precursor to gold's future? I'm making good gains Shorting silver right now. DZZ looks good buying cheap Down Gold.

http://www.providentmetals.com/bullion/copper/1-2-avdp-pound.html Check out the Shiny Copper bars!

Edit..forgot to upload a Copper graph.I'm assuming copper will drop and will watch the prices to see if they fluctuate with the pounds I bought.Will load up if it hits around the $1-$2 level

I'm still hanging around the 400 Level and got 33 points today with Shorting 3 silver stocks and oil.I re-added Netflix since it's reporting after Monday's close..Shorted it at $165-$119.Got alot of points so hopefully,Netflix did cause alot of damage with the price increase so we'll find out.Some stocks seems to be on the bottom of a cycle like SKF.I made be just lucky to get out of them and get the points lost.

I did something cool today,,,After hearing about Copper's Decline from the $4.65 (high) level with $1.25 (low) and now at $3.20 Spot.(61% seems bullish on copper and 19%-19% were undecided and bearish) and I went out and got some Copper Bars by the Pound and two 1/2 Pounders.For $25.00 with shipping.I don't mean to spam anyone's website but the website looked good and I'm waiting for delivery.If it goes down in price...I'll get more for fun and I'll be waiting on the housing to recover in case copper is needed. On the other hand..Does this mean also Gold will drop too? Is Copper the precursor to gold's future? I'm making good gains Shorting silver right now. DZZ looks good buying cheap Down Gold.

http://www.providentmetals.com/bullion/copper/1-2-avdp-pound.html Check out the Shiny Copper bars!

Edit..forgot to upload a Copper graph.I'm assuming copper will drop and will watch the prices to see if they fluctuate with the pounds I bought.Will load up if it hits around the $1-$2 level

Last edited:

I love Max. Nice to see someone from the industry being honest. Funny stuff too lol.If you subscribe to RussiaToday on youtube you get those videos from Max Keiser a few times a week, he is so funny. He knows whats up too when it comes to the financial system and its corruption.

Lots of downside risk tomorrow. Europe, surprise, surprise, is at an impasse to save the world. Dr. Copper has been tanking over the past few days. Equities should follow. Going to have to review my short term bullishishness.

EU Debt Talks Stalled Over Bailout Fund: Sarkozy CNBC

It's print or die for the ECB.Plans to tackle the euro zone debt crisis have stalled with Paris and Berlin at odds over how to increase the firepower of the region's bailout fund, French President NicolasSarkozy said on Wednesday.Sarkozy told French parliamentarians the dispute was holding up negotiations. He then flew to Frankfurt to talk with German Chancellor Angela Merkel in an attempt to break the deadlock ahead of a make-or-break European leaders' summit on Sunday.

A French presidency source said the French and German leaders were meeting other euro zone policy chiefs and International Monetary Fund head Christine Lagarde on the sidelines of an event mark the end of Jean-Claude Trichet's presidency of the European Central Bank.

France has argued the most effective way of leveraging the European Financial Stability Facility is to turn it into a bank which could then access funding from the ECB, but both the central bank and the German government have opposed this.

"In Germany, the coalition is divided on this issue. It is not just Angela Merkel who we need to convince,'' Sarkozy said to the parliamentarians at a lunch meeting, according to Charles de Courson, one of the legislators present.

His comments fueled doubts about whether euro zone leaders will be able to agree a clear and convincing plan when they meet on Sunday.

Failure to do so would further undermine financial markets' already shattered confidence in the currency bloc and its ability to get on top of a two-year-long debt crisis, which threatens the long-term viability of the single currency.

One senior EU official, who is involved in coming up with solutions to the crisis, said the only "circuit-breaker'' now was for the ECB to make an explicit commitment to go on buying distressed euro zone debt for "as long as it takes,'' something Trichet has said should not happen.

Dr. Copper isn't looking so hot.

The Doctor Needs A Priest, Stat

Doctor copper that is. Because apparently someone forgot to tell China that "Europe is fine." As a result, over the past 3 days we have seen a relentless selloff in all risk assets and commodities when China is open (the weak GDP print sure didn't help), at time bordering on liquidation, but most notably in copper which is now down 7% on the week, and which in a feedback loop forces domestic speculators to sell anything that is not nailed down, due to copper's use a core Letter of Credit pledge. As a result, any drop in copper leads to leveraged selloffs in all other assets, which leads to even more selling in copper and so on. Perhaps the Beijing editions of the FT or The Guardian can promptly put an end to this lunacy, which can be ignored by vacuum tubes only for so long...

hehe we posted at the same time about Dr. Copper. If he goes down significantly everything else typically follows. Gold and silver too initially I would imagine.Does this mean also Gold will drop too? Is Copper the precursor to gold's future? I'm making good gains Shorting silver right now. DZZ looks good buying cheap Down Gold.

robbiedublu

Member

Federal Reserve Now Backstopping $75 Trillion Of Bank Of America's Derivatives Trades

I don't believe there's any way this will be allowed to stand. When B of A fails and people can't get their FDIC insured deposits back because .gov has to pay off 75 trillion ( yes that's TRILLION, with a T) in derivatives before they can pay off anyone else, people are gonna go crazy. Why does anyone still have any of their $ in B of A anyway ?

75 trillion is aprox all of the money in existence in the entire world.

hehe we posted at the same time about Dr. Copper. If he goes down significantly everything else typically follows. Gold and silver too initially I would imagine.

Alright..let me put up DZZ on the portfolio.I was bullish at $13.00 on this other portfolio and it's around the $5.00 Now and So I'll put in a 3 year time frame.

Alright..let me put up DZZ on the portfolio.I was bullish at $13.00 on this other portfolio and it's around the $5.00 Now and So I'll put in a 3 year time frame.

B of A might break up into tiny banks called

BofA Island Bank

BofA Main Land Bank

BofA City Bank

BofA Credit Bank

BofA Foreign Bank

.....Well hey, Gotta diversify.

The fact that the number "trillion" has become normalized in monetary and fiscal policy is insanity. Talk about a bubble lol. Ahh, the wonders of fiat and false promises.

Trillion until recently was only used in the astronomy lexicon. "Trillions of miles/light years away".

BankofAmericaMerrilLynchCountryWideWarrenBuffet is a mulch-trillion toxic waste dump. Depositors will need to bring their pitchforks to make a withdrawal.

Trillion until recently was only used in the astronomy lexicon. "Trillions of miles/light years away".

BankofAmericaMerrilLynchCountryWideWarrenBuffet is a mulch-trillion toxic waste dump. Depositors will need to bring their pitchforks to make a withdrawal.

The fact that the number "trillion" has become normalized in monetary and fiscal policy is insanity. Talk about a bubble lol. Ahh, the wonders of fiat and false promises.

Trillion until recently was only used in the astronomy lexicon. "Trillions of miles/light years away".

BankofAmericaMerrilLynchCountryWideWarrenBuffet is a mulch-trillion toxic waste dump. Depositors will need to bring their pitchforks to make a withdrawal.

the funniest thing is: to an average person the word trillion doesnt really differ from a word million or billion too much.

N

Nondual

I go back to what Warren Buffet said which is it is not possible to unwind all of the derivatives currently in place. At some point the house of cards will fall down.I don't believe there's any way this will be allowed to stand. When B of A fails and people can't get their FDIC insured deposits back because .gov has to pay off 75 trillion (yes that's TRILLION, with a T) in derivatives before they can pay off anyone else, people are gonna go crazy. Why does anyone still have any of their $ in B of A anyway ?

75 trillion is aprox all of the money in existence in the entire world.

On a brighter note...

CHICAGO (Reuters) - An unofficial gauge of human misery in the United States rose last month to a 28-year high as Americans struggled with rising inflation and high unemployment.

The misery index -- which is simply the sum of the country's inflation and unemployment rates -- rose to 13.0, pushed up by higher price data the government reported on Wednesday.

The data underscores the extent that Americans continue to suffer even two years after a deep recession ended, with a weak economic recovery imperiling President Barack Obama's hopes of winning reelection next year.

Inez Stallworth, an underwriting assistant for a financial services company, recently gave up her car, in part because of rising costs for gasoline and groceries.

"I can't fit it in," said the 27-year-old Chicago resident, who said most of her extended family was getting by "paycheck-to-paycheck."

Consumer prices rose 3.9 percent in the 12 months through September, the fastest pace in three years.

With gasoline prices high, consumers have less to spend on other things. Moreover, a rise in overall prices saps economic growth, which is typically measured in inflation-adjusted terms.

The last time the misery index was at current levels was in 1983. But in 1984 an improving economy probably helped President Ronald Reagan win reelection. This year, the index has risen more than 2 points.

The rumor mill out of Europe was full retard today. Still no details of course. Germans basically said nothing is going to come out of this weekends summit so they will have another meeting later next week. There were reports that this weekend's summit was going to be delayed because there is no fundamental agreement, but I guess they decided since the hotel and catering was already booked they'd have the meeting this weekend even if to only announce that they would make an announcement to announce a plan for a plan at a later date.

God bless my credit union

I got a loan and saved 8% which is about $40 per month in interest last week.

19.9% to 11.6%... Credit Union rules.They gave me a credit card when no one did.Of course,,,The Credit Market was locked down about 2-3 years ago.Now,Finally, it seems more relaxed since I was approved for a Loan and the reason for the loan was to save interest every month.That's the only reason.They Said "Yes".

Copper Gained just .15 Cents today. $3.05 to $3.15.Seems I found a bottom..Hope it Holds.Wonder What Would Happen when Q3 is Put to use.

Awesome savings. That 8% difference was profit-taking, advertising costs, and golden parachutes for banksters.

Yessir, banks are obsolete, let those fuckers fail and the credit unions will take the entire consumer market.

Best thing about my credit union is I don't have to worry about them sneaking a new fee or an increase.

Integrity. It is sooo refreshing in this Gilded Age.

Yessir, banks are obsolete, let those fuckers fail and the credit unions will take the entire consumer market.

Best thing about my credit union is I don't have to worry about them sneaking a new fee or an increase.

Integrity. It is sooo refreshing in this Gilded Age.

N

Nondual

N

Nondual

More good news...

WASHINGTON (AP) — Fifty percent of U.S. workers earned less than $26,364 last year, reflecting a growing income gap between the nation's rich and poor, the government reported Thursday.

There were fewer jobs, and overall pay was trending down — except for the nation's wealthiest. The number of people making $1 million or more soared by over 18 percent from 2009, the Social Security Administration said, citing payroll data based on W-2 forms submitted by employers to the Internal Revenue Service.

Despite population growth, the number of Americans with jobs fell again last year, with total employment of just under 150.4 million — down from 150.9 million in 2009 and 155.4 million in 2008. In all, there were 5.2 million fewer jobs than in 2007, when the deep recession began, according to the IRS data.

The figures are just one more indication of the toll that the worst downturn since the Great Depression has taken on the U.S. economy. They were published as demonstrations rage on Wall Street and in cities across the nation protesting a widening income gulf between average wage earners and the nation's wealthiest.

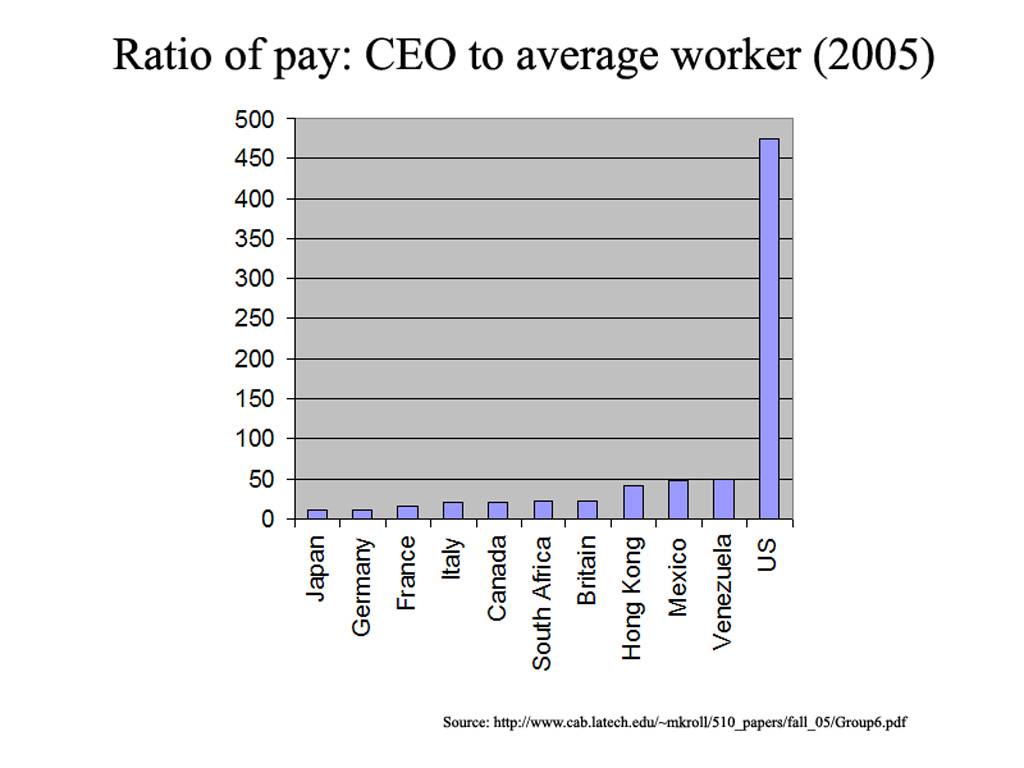

Putting our society in perspective with other nations... I know its 2005 data  . Wow Germany typically has their shit together economically, look at that low ratio they have. Just shows that good wages improves the economy (and families, and communities, and the nation). Fact.

. Wow Germany typically has their shit together economically, look at that low ratio they have. Just shows that good wages improves the economy (and families, and communities, and the nation). Fact.

my view of PEET:

position should still be profitable imo w/ decent timing. already @2.60/2.90. you holding any thru the weekend? im still holding a target of 1265/1275S&P, 11857/12k DJI after testing 1191S&P, but this shit could roll over any day. still buying the short term dip, working in nov calls now. look for the EU to promise the moon, but logically not be able to deliver. selloff on failing to deliver.

btw, China is slowly beginning to unwind their US Treasury reserves. whether it is just to send a message, to alleviate a possible liquidity squeeze they may be experiencing, or to bank some profit while the USD has some relative strength, only the movers know. will be watching to see if it continues, increases, or abates. i really hope AU hits 1k in the next 6mo so i can cash out and call it quits. FEDs all talking about MBS purchases already. i dont want to hear about QE4 yet. w/i 10yrs (~6 imo) there will either be a revolution in this country or a world war in which it will take central part. the seeds have already been sown. of course, the populations always have a choice. the revolution could be peaceful w/ the goal to enact positive change. the war could be of ideals instead of arms. unfortunately, i have little faith in humanity to make the correct decisions. if there is hope, it lies in the proles. stay frosty,

-iD

position should still be profitable imo w/ decent timing. already @2.60/2.90. you holding any thru the weekend? im still holding a target of 1265/1275S&P, 11857/12k DJI after testing 1191S&P, but this shit could roll over any day. still buying the short term dip, working in nov calls now. look for the EU to promise the moon, but logically not be able to deliver. selloff on failing to deliver.

btw, China is slowly beginning to unwind their US Treasury reserves. whether it is just to send a message, to alleviate a possible liquidity squeeze they may be experiencing, or to bank some profit while the USD has some relative strength, only the movers know. will be watching to see if it continues, increases, or abates. i really hope AU hits 1k in the next 6mo so i can cash out and call it quits. FEDs all talking about MBS purchases already. i dont want to hear about QE4 yet. w/i 10yrs (~6 imo) there will either be a revolution in this country or a world war in which it will take central part. the seeds have already been sown. of course, the populations always have a choice. the revolution could be peaceful w/ the goal to enact positive change. the war could be of ideals instead of arms. unfortunately, i have little faith in humanity to make the correct decisions. if there is hope, it lies in the proles. stay frosty,

-iD