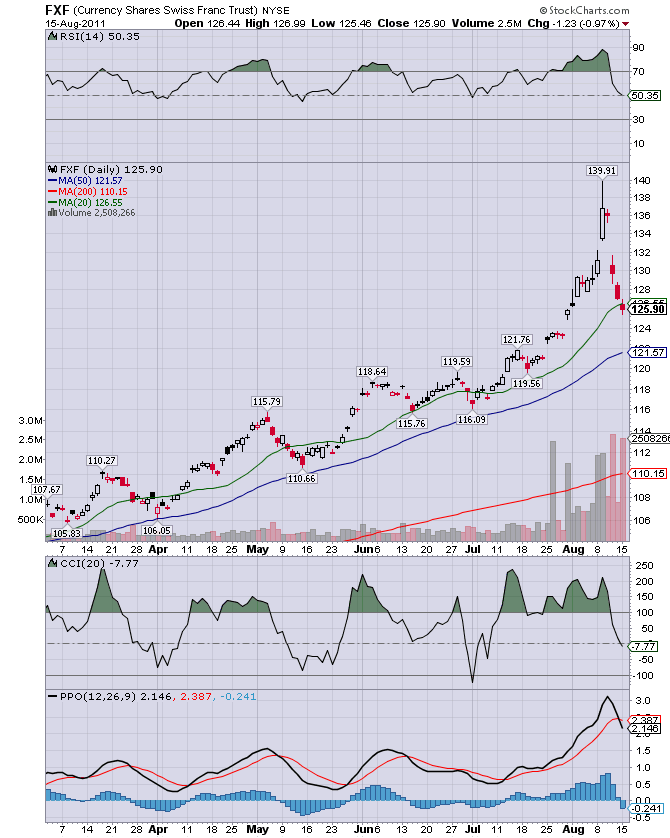

Bernanke is dropping bombs on the Swiss. I bet the Japanese are going to have to intervene too. The dollar is tanking. Hot potato. Hot potato.

Swiss Ponder Battle Over Runaway Franc Bloomberg

I read somewhere that a Big Mac was ~$18 in Switzerland now. Racing to the bottom rounding turn two. Like I said. Financial warfare. In my signature Einstein ponders what weapons WWIII will be fought with. I believe I have his answer. Credit derivatives and printing presses.

Swiss Ponder Battle Over Runaway Franc Bloomberg

Switzerland, the nation that hasn’t gone to war with a foreign power since Napoleon, is reluctantly debating a generational taboo: ceding monetary independence to win a battle over its runaway currency.

Swiss National Bank Vice President Thomas Jordan said the central bank is assessing “a whole range of options” to prevent the franc, which reached a record against the euro this month, from making Swiss goods prohibitively expensive. Even a cup of coffee at Café St. Gotthard in Zurich costs $8.30, with one Swiss franc buying $1.2750 at today’s exchange rate.

Billionaire entrepreneur Christoph Blocher, one of the politicians who called on SNB President Philipp Hildebrand to resign after the bank lost $21 billion last year in a vain attempt to restrain the currency, now supports a franc target.

“The franc is catastrophically overvalued,” said Blocher, a former justice minister for the People’s Party, Switzerland’s largest. “It’s almost like economic warfare -- to wage a war, you must use all measures at your disposal, and you must win.”

I read somewhere that a Big Mac was ~$18 in Switzerland now. Racing to the bottom rounding turn two. Like I said. Financial warfare. In my signature Einstein ponders what weapons WWIII will be fought with. I believe I have his answer. Credit derivatives and printing presses.